How much retirement income is enough?

Your retirement account balance may look like a hefty amount–or you expect it will be by the time you reach your target retirement age. But will that amount, along with any income you receive from Social Security and other sources, be enough to live on for the rest of your days?

How far will your retirement income go?

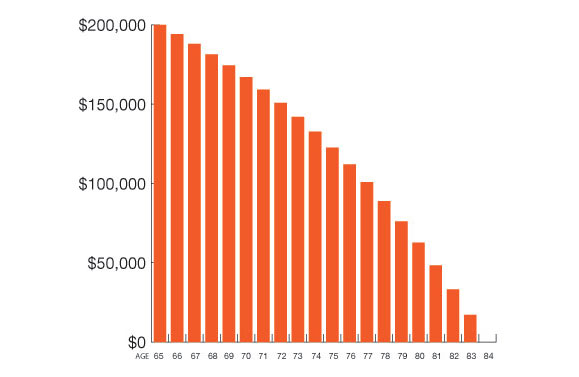

Let’s say you retire at age 65 with an account balance of $200,000–a pretty big number by most standards–and you want to withdraw $1,500 a month (before tax). At that rate, you’ll draw your account balance down to zero in a little over 18 years–a potential problem if you live past age 83.

FOR ILLUSTRATIVE PURPOSES ONLY. This hypothetical illustration does not represent the performance of any particular investment options. It assumes a beginning account balance of $200,000, monthly pre-tax withdrawals of $1,500, no contributions, a 6% annual rate of return and reinvestment of earnings. Rates of return may vary. The illustration does not reflect any charges, expenses or fees that may be associated with your Plan. The hypothetical earnings would be reduced if these fees had been deducted. Source: Empower Retirement, 2011

DreamTrackerSM can help you learn what will your retirement income be based on my current savings habits, how an increase to your paycheck contributions will affect your retirement income and how your outside assets influence your projected retirement income amount?

DreamTracker

DreamTracker is a tool you can use at any time. And it can add value by helping you adjust your savings strategy if your retirement income goals change over time.

Once you enroll in your plan, you’ll have access to transactional features and tools through your plan’s website that can potentially help you reach your retirement income goals. The following are some examples of the features and tools you’ll have at your fingertips.

Each time you log in, you’ll see a retirement income projection based on your current balance, contributions and estimated rate of return, which can help you keep your retirement strategy on track.

You’ll be able to manage your account and make changes affecting your savings and investments.

The Asset Allocation Guidance Tool is available to you and can provide you with a recommended paycheck contribution amount and suggested asset allocation based on your retirement income goals.

There are many good reasons to save for retirement. One of the most important is to make sure you have an income when you’re no longer working. The first step is getting enrolled. And once you do, these tools and features can help keep you on the right path.