What type of investor are you?

It is important to select investment options from your employer-sponsored retirement plan that are right for your unique situation. With a better understanding of who you are as an investor, you’ll have the information you need to get started on selecting your investment options.

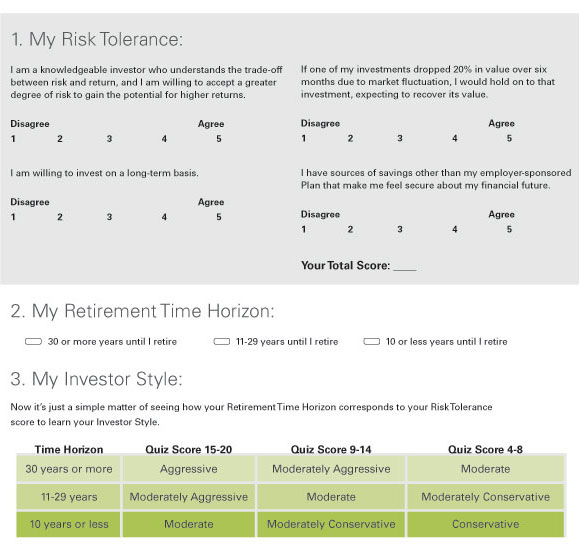

Choosing the investments that will put you on the right path toward your retirement goals doesn’t have to be a challenge. In three easy steps, you can learn which investment choices may be right for you:

After completing these three steps, you may be better prepared to choose your investment options. Click on the Tools and Resources tab see sample portfolios based on the different investor styles, which may help you with your investment option decisions.

You can see what a sample portfolio may look like based on your personal investment style, and you can use DreamTrackerSM to see how different investment returns could affect your retirement income.

DreamTracker is a tool you can use at any time. And it can add value by helping you adjust your savings strategy if your retirement income goals change over time.

Once you enroll in your plan, you’ll have access to transactional features and tools through your plan’s website that can potentially help you reach your retirement income goals. The following are some examples of the features and tools you’ll have at your fingertips.

Each time you log in, you’ll see a retirement income projection based on your current balance, contributions and estimated rate of return, which can help you keep your retirement strategy on track.

You’ll be able to manage your account and make changes affecting your savings and investments.

The Asset Allocation Guidance Tool is available to you and can provide you with a recommended paycheck contribution amount and suggested asset allocation based on your retirement income goals.

There are many good reasons to save for retirement. One of the most important is to make sure you have an income when you’re no longer working. The first step is getting enrolled. And once you do, these tools and features can help keep you on the right path.